Latest Article:

FEATURED:

The Affordable Care Act (ACA) was designed to ensure that employees were offered timely and affordable healthcare by their employers. Read the article to find out reporting deadlines, common mistakes to avoid, and more.

In today's competitive workforce, standing out at work has become more important than ever. Read the article to learn 10 things you can do to stand out at your workplace.

Planning for retirement may seem like a distant goal when you're young and starting out in your career. However, the truth is that saving for retirement early in life is crucial for securing a comfortable and financially stable future.

The start of a new year often brings a surge of motivation and the best of intentions to make positive changes in our lives. If you're determined to stick to your goals and not give up at the first sign of struggle, here are some tips to help you stay on track.

The holidays emphasize the importance of recharging and reevaluating our priorities. By doing so, we can return to our work life invigorated, with a renewed sense of purpose and perspective.

Having safe and efficient mental health strategies in the workplace can increase employee retention but even more importantly make employees feel safe, appreciated, and cared for. Read this article that reviews 5 simple steps to make this happen.

In today's interconnected world, our reliance on technology has opened a new realm of threats - cyber threats. The rapid advancement of digitalization has provided immense opportunities, but it has also attracted malicious actors looking to exploit vulnerabilities for personal gain.

The Affordable Care Act (ACA) was designed to ensure that employees were offered timely and affordable healthcare by their employers. Read the article to find out reporting deadlines, common mistakes to avoid, and more.

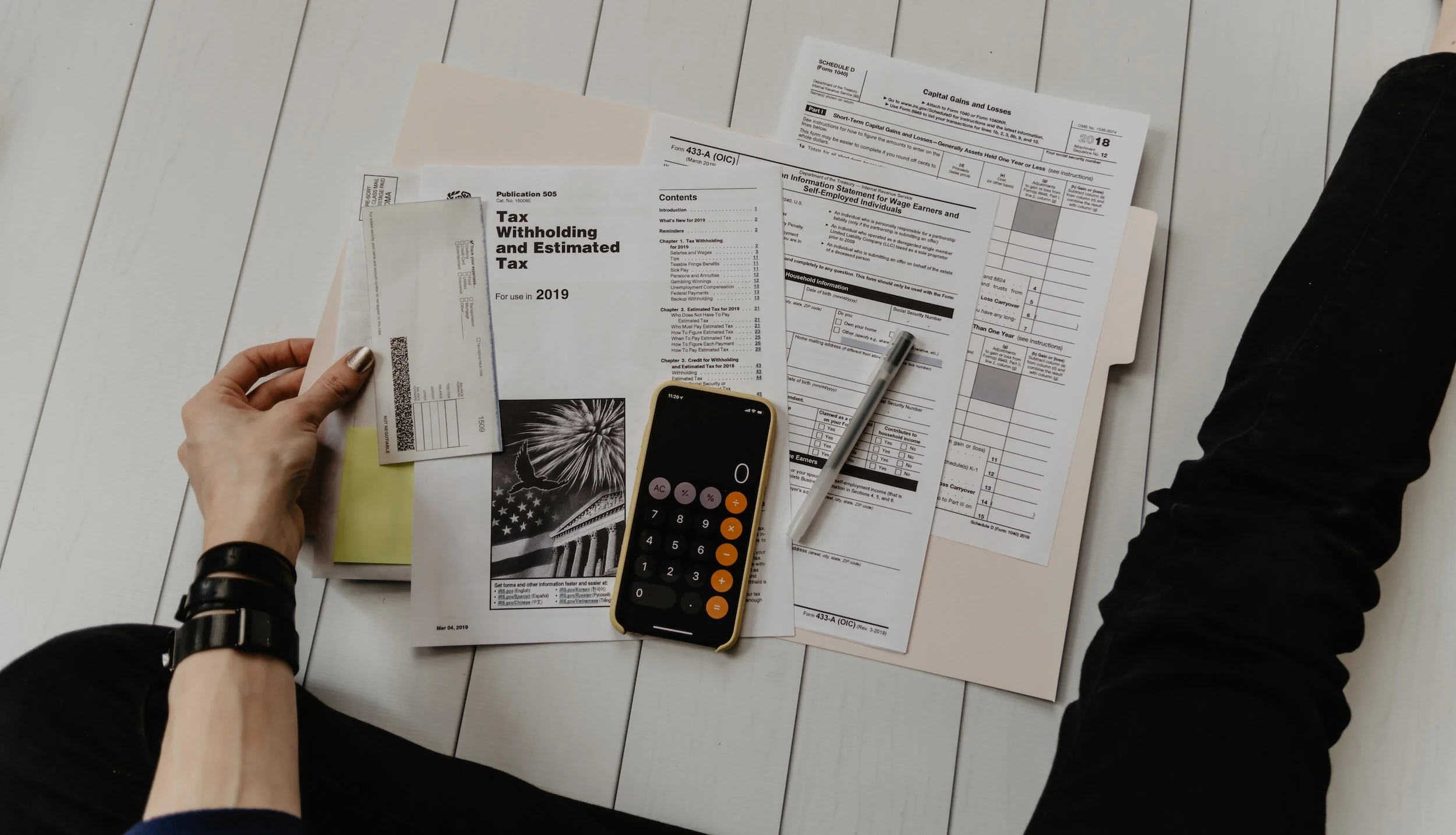

The Internal Revenue Service announced an increase in the 401k and IRA contribution limits for 2024. Now you can save even more for your retirement and secure a brighter tomorrow.

Under this new proposal, any non-exempt employee who is on a salary and does not have supervisory responsibilities can earn up to $55,000 per year. If their salary falls below this threshold and they work more than 40 hours in a week, you would be obligated to pay them overtime, which is calculated at 1.5x their hourly rate.

The IRS recently stopped processing Employee Retention Tax Credit (ERTC) claims. The ERTC was introduced during COVID as a pandemic-related tax credit that offered money to help employers that retained their employees during the pandemic.

If you find yourself in a situation where you believe you have been billed too much by your healthcare provider's office or insurance carrier, it's essential to address this promptly.

When you apply through your state-funded health insurance program, you may be eligible for premium discounts that can make quality healthcare more accessible.

By understanding your plan and taking full advantage of the benefits it offers, you can ensure you receive the care you need without breaking the bank.

To help you make well-informed decisions regarding your health insurance, we have compiled a list of commonly asked questions about health insurance.

If you find yourself in a situation where you believe you have been billed too much by your healthcare provider's office or insurance carrier, it's essential to address this promptly.